How much do you want to save?

Understand and maximize your retirement plan

The primary 401(k) advantage

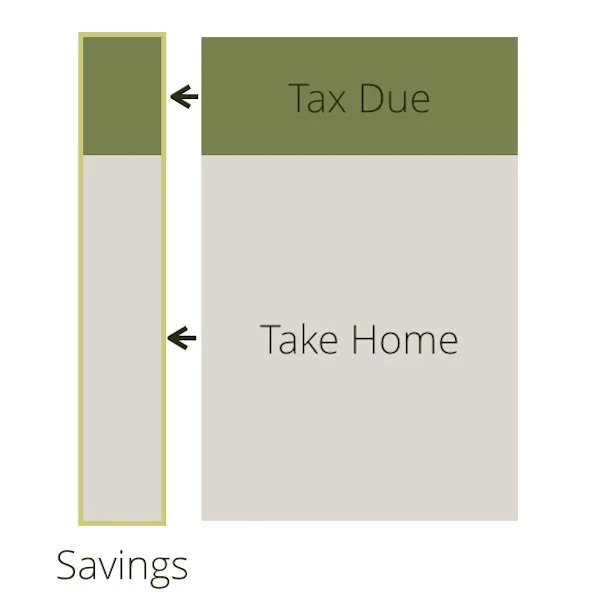

Your 401(k) contributions use pre-tax dollars in the understanding that upon retirement you will use this money as income and pay taxes then. Essentially, you are growing your own money "plus" some money on loan from the government. This reduces your tax liability during your working years and allows for increased potential growth of your assets through retirement.From the outset, we take great care to listen to business owners and plan administrators. Using your best projections for the future, we'll find a custom solution for your retirement plan needs and walk you through the implementation.

Can I afford not to?

It takes discipline to look at the real cost of retirement. And, while knowing how much you will need to save to safely retire is a complex question, it's too important to ignore. Below is a chart showing an estimate of the nest egg you need in order to replace various levels of income. It also shows how much you need to save given different time horizons.

A 401(k) plan is a critical retirement tool for most people. Hopefully you have some idea of what you'll need to put away based on the chart above. And, as you've likely noticed, you may need to contribute more than the limits of a typical IRA. This is where a 401(k) can help.

An example:

The table above can feel daunting. Most people don’t feel they can save that much money each year. It is important to keep in mind that some of those dollars come from tax advantages, while others may come from your employer. Take a look at two example people we drew up, Randy and Sandy, and notice what they are doing to build up their 401(k)s.

What's right for Randy isn't necessarily what is right for Sandy. Social security and other income streams in retirement affect people in a variety of ways. Whatever your situation, it will be important to balance your various resources. If you have questions, feel free to give us a call.