Where to House Your Emergency Fund

Field Note: October 2019

According to the 2018 Federal Reserve Report on Economic Well-Being of US Households, nearly 40% of Americans do not have enough cash reserves to cover an unexpected $400 expense. An additional 12% say they could not pay their monthly bills if faced with that same unexpected expense. The remedy for life’s unexpected financial hardships is an emergency fund, the bedrock of any sound financial plan.

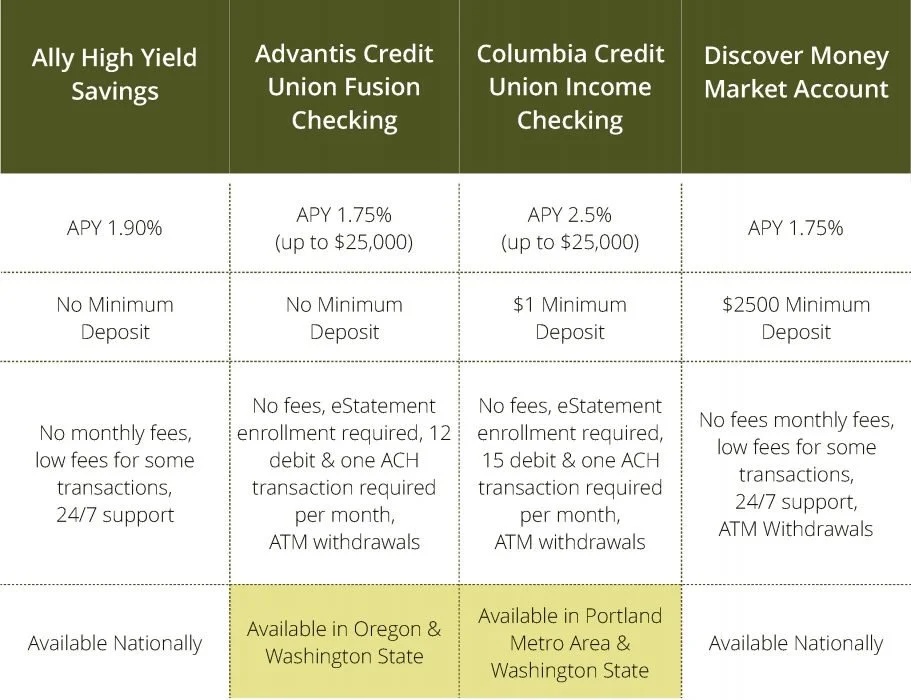

A fully funded emergency fund contains four to six months of expenses. In order to get the most out of this savings, Skyline recommends clients seek out something beyond a generic savings account, which yields an average of .09% annually. Below is a comparison of four accounts that could be used to house an emergency fund: Ally Bank Online Savings, Advantis Credit Union Fusion Checking, Columbia Credit Union Income Checking, and Discover Money Market Account.

Determining which account is a good fit for your emergency fund requires weighing several factors. Naturally, interest rate and organizational fees are to be considered. Other variables include how frequently interest is compounded, minimum deposit or balance requirements, and other miscellaneous stipulations (such as transaction requirements or early withdrawal fees).

Sites like Bankrate and Nerd Wallet offer comparison tools, displaying high yield savings options side by side. These tools allow for personalization of location, expected deposit and deposit term. If you would like to discuss which account is the best fit for your emergency fund, contact your Skyline advisor today.