Inflation: Don’t Panic and Carry On

Field Note: June 2021

There’s no shortage of news coverage on the pandemic recovery: vaccination rates, economic outlook, job reports. One such topic receiving an abundance of coverage and hype is inflation.

If you’ve followed along at all, the coverage on inflation can make it out to be a nebulous, impending doom that will wreak financial havoc for us all. While inflation does pose a real potential risk to our economy, the current outlook points to a temporary increase in inflation caused by the unprecedented challenges of reopening a post-pandemic economy rather than a long-term trend that should cause worry.

The largest contributor to inflation, and one that the Federal Reserve Board has been warning about for months, is the misalignment of supply and demand. Supply chains were slowed down over the last year as life as we knew it ground to a near halt. This spring, as stimulus checks arrived and cities began quickly reopening (thanks, vaccines!), consumers were eager to spend money. Demand outpaced the available supply in many sectors (think cars, lumber, etc.) causing product shortages and price increases. This mismatch in supply and demand is temporary as supply chains ramp up to meet the post-pandemic demand. As supply and demand smooth out, prices and inflation should shift down to their normal levels.

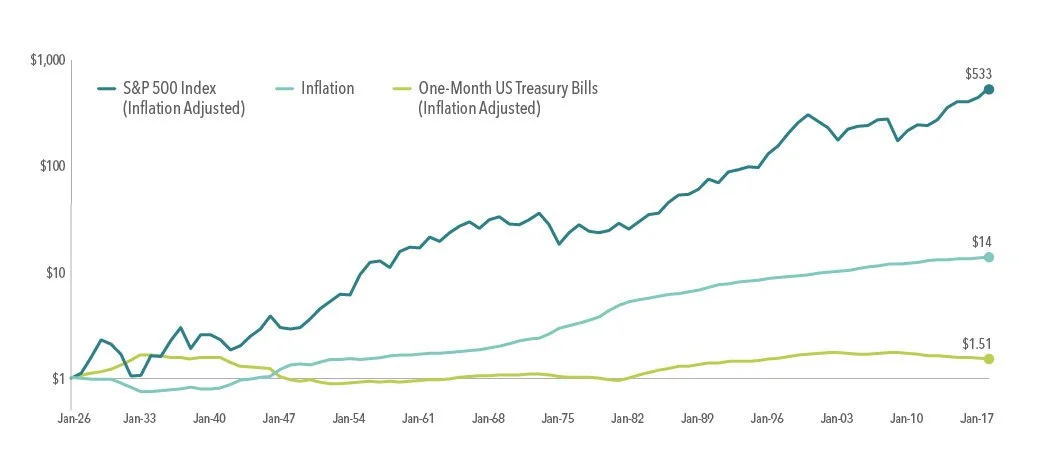

Growth of $1, 1926-2017

S&P and Dow Jones data © 2018 Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Past performance is no guarantee of future results.

Actual returns may be lower. Inflation is measured as changes in the US Consumer Price Index.

Long-term, the Federal Reserve Board aims to keep inflation rates at 2 percent. Rates over the last decade have averaged lower than 2 percent. In their March board meeting, the Fed noted that they would aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time. If things go sideways in the coming months and inflation continues to climb, the Fed has indicated they will intervene with monetary policy to guide inflation back to target. This intervention typically stifles economic growth and could trigger a recession, so we hope it doesn’t come to that.

Consumers can have an (unintended) impact on inflation, too. Much like the mention of a potential toilet paper shortage can lead to panic buying and result in an actual shortage, the anticipation of increasing inflation can lead to consumer behavior that actually contributes to higher inflation. The economy is very much still moving with the pandemic and doing some unusual things (both inflation and wages are on the rise when they typically have an inverse relationship). We expect more strangeness from the economy as we slowly emerge from the last year.

The moral of the story: don’t panic and carry on as best as normal (whatever “normal” is these days).

If you’d like to discuss the potential impact of inflation on your portfolio, contact your Skyline advisor today. Want to read more about inflation? We recommend these two articles:

How Does Inflation Impact Investors? (2018)

Inflation: An Exchange between Eugene Fama and David Booth (2021)

“Minutes of the Federal Open Market Committee.” Board of Governors of the Federal Reserve System. March 16–17, 2021

"Remaining Steady as the Economy Reopens by Governor Brainard". Board of Governors of the Federal Reserve System. June 1, 2021

“What Inflation Retail Sales and Relief Payments are Telling Us about the Economic Recovery.” Marketplace by American Public Media. May 14, 2021.