Credit Scores

Field Note: September 2019

At 13.86 trillion, consumer debt is higher than ever, ensuring our credit scores remain a feature of the everyday, American financial life. Used by 90% of lenders, FICO credit scores have dominated the industry since their origination in the 1980s. FICO refers to Fair Isaac Corporation (an American technology company). Fair Isaac developed a credit bureau risk model by gathering information from the major US credit reporting agencies – Equifax, TransUnion and Experian – and producing a figure that predicts a borrower’s likelihood of fulfilling their obligation.

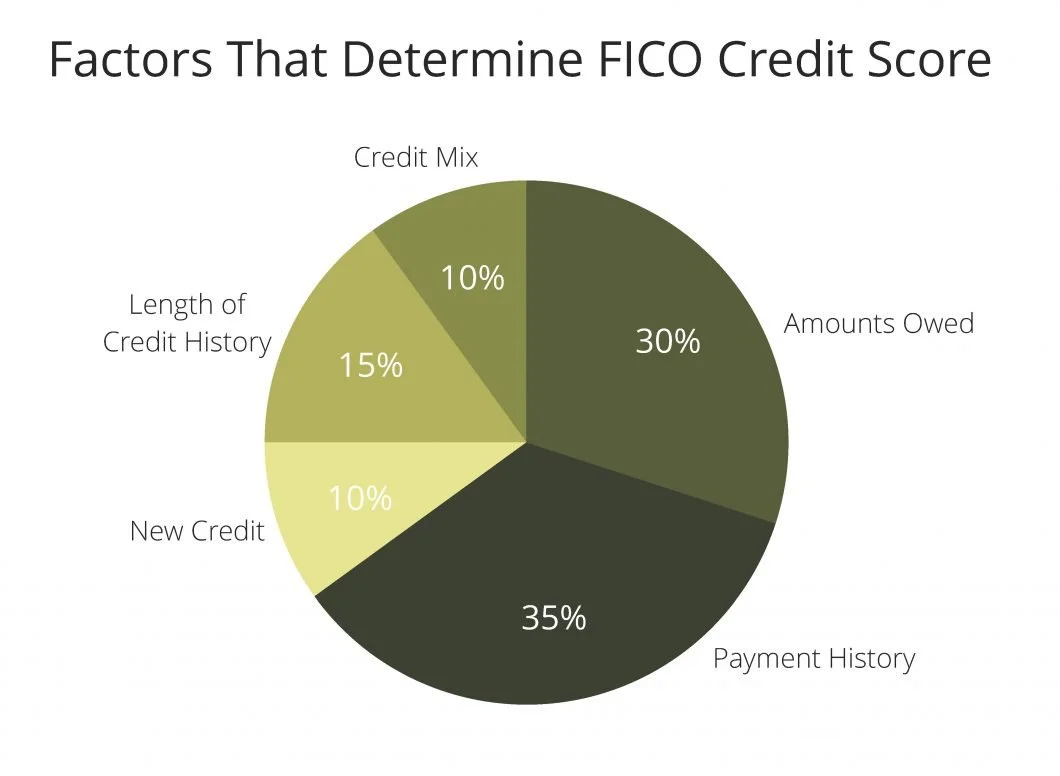

Within the FICO model, five factors are considered:

Payment History (35%): Up to seven years of payment history is considered including the absence or presence of derogatory payment information (bankruptcy, civil judgments, foreclosures, etc.). FICO also considers details of late payments such as how late and how much was owed.

Amounts Owed (30%): Borrowers who run balances consistently close to their maximum available credit are considered a higher risk to lenders. Prime utilization rates are between 1%-30% of total credit available.

Length of Credit History (15%): Simply closing accounts can have a negative effect on credit scores. Age of oldest account, average age of credit accounts and age of newest account are all factors included in this factor.

Credit Mix (10%): Lenders view borrowers who successfully juggle more than one type of credit in a positive light. Scores increase as consumers show a history of managing payments on a variety of credit types such as mortgages, student loans, credit cards and car loans.

New Credit (10%): Hard credit inquiries occur when a borrower applies for an auto loan, line of credit or credit card. Opening several new lines of credit in a short period of time makes a consumer more of a risk. As a result, hard inquiries and new lines of credit negatively affect FICO scores.

Source: FICO

There are additional credit scores: VantageScore (VS) is a proprietary score developed by reporting agencies TransUnion, Equifax and Experian. Preferring to steer away from the percentages like FICO models use, VantageScore describes payment history as extremely influential and total balances as moderately influential whereas recent debt and credit behavior are considered less influential. Interestingly, a VS score may benefit those with limited credit history. This is due to the fact that their model takes into consideration rent, utilities and phone payments and requires just a month or two of credit history (FICO requires six months).

Websites such as Credit Karma, Credit Sesame and Bankrate allow consumers access to credit related data and scores without having to pay a one time or monthly fee. Each of these sources use varied scoring models. Though these models do not produce the exact scores used by lenders, they can offer an opportunity for consumers to see what range their credit score is in and what factors influence their credit score presently.

Ultimately, consumers who are seeking to build, maintain or rebuild credit should prioritize on time payments, utilize between 1-30% of their available credit and avoid multiple hard inquiries in a short period of time. If you are concerned about your credit score, contact your Skyline Advisor today.