What’s in a Basket of Goods? CPI and it’s Impact.

Field Note: June 2023

In the world of economics, there are several indicators that help us understand the health and performance of an economy. One that has been persistently present in recent years is the Consumer Price Index (CPI) as it is the most common inflation measurement. CPI provides valuable insights into the level of inflation and the purchasing power of consumers.

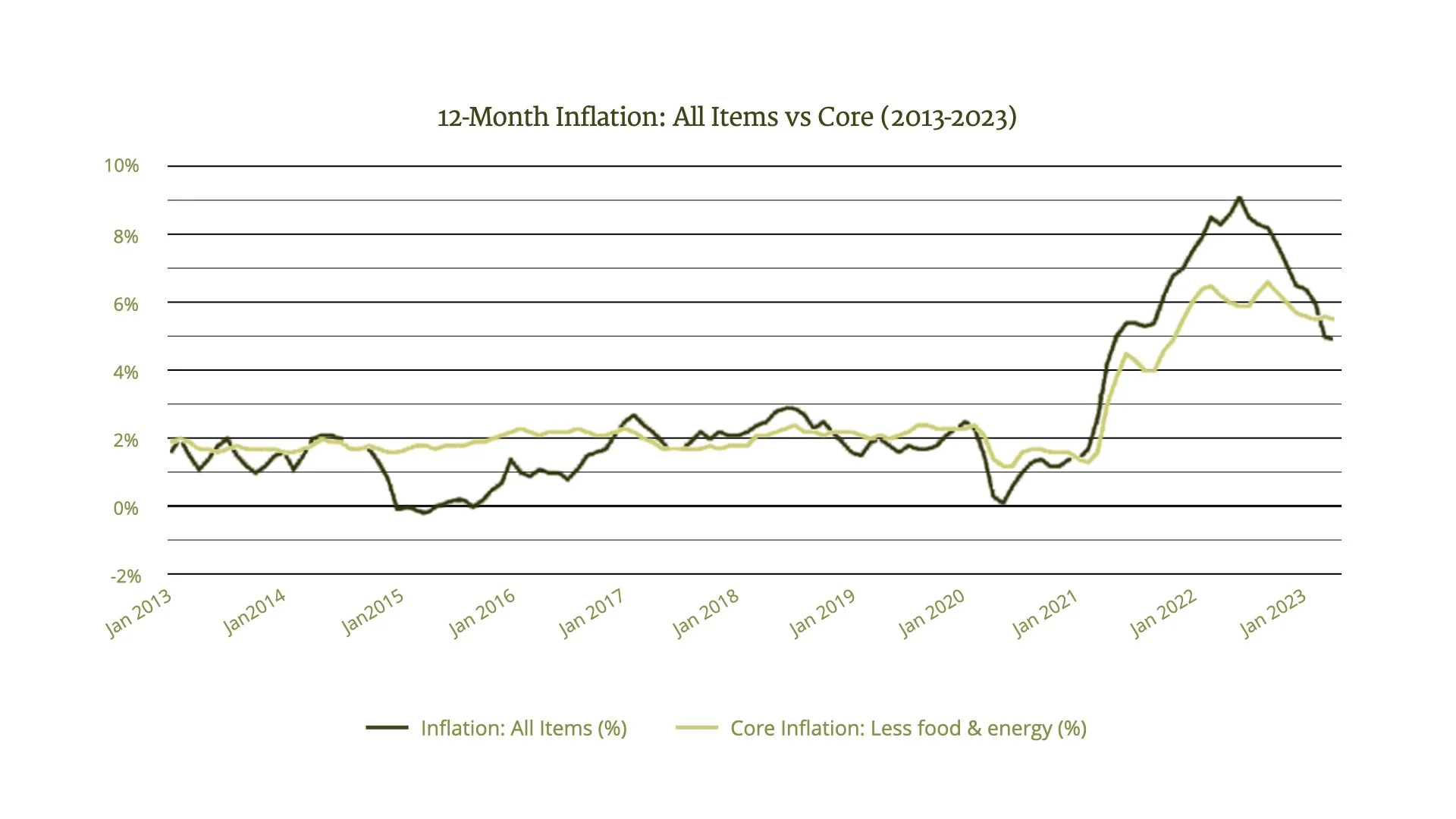

The Bureau of Labor Statistics (BLS), who measures and tracks CPI, released their April numbers, reporting a CPI increase of 5.3 percent over the last 12 months1. That is down from a 6.9 percent increase in January2. CPI measures the average change in dollars paid by urban consumers for a basket of goods and services over time. This is done by tracking prices for various essential items, like gas, groceries, clothes and housing. Returning to the above statistic, the goods measured were 5.3% more expensive in April 2023 than in January, collectively (not that every item’s price has increased 5.3%). The goods and services represented by CPI span across 200 categories, which are placed into eight major groups.

Two flavors: CPI and Core CPI

For a clearer picture of underlying inflation trends, economists often rely on an alternative measure known as Core CPI. Core CPI looks at the same basket of goods and services, but excludes food and energy prices. These tend to be more susceptible to short-term supply and demand shocks, making them highly volatile. Excluding food and energy components provides a more stable measure of inflation, allowing economists and policymakers to identify underlying inflationary trends and long-term pricing changes in the economy.

Nonetheless, food and energy costs are essential components of household budgets and can significantly affect consumers' living standards. Therefore, CPI remains important for assessing the overall cost of living and adjusting benefits and wages accordingly.

The Utilization of CPI

The CPI holds significant importance for policymakers, businesses, and consumers alike.

Inflation Measurement: CPI is primarily used to quantify inflation. By tracking the change in prices of essential goods and services, policymakers and economists can evaluate the rate at which the general level of prices is rising. This data informs monetary and fiscal policies, as well as investment decisions.

Cost-of-Living Adjustments: Many labor contracts, government benefits, and social security payments are linked to the CPI. Cost-of-living adjustments (COLAs) are made based on changes in the CPI to ensure that individuals' wages and benefits keep up with inflation. Therefore, accurate CPI calculations are essential for maintaining the purchasing power of individuals and protecting their standard of living.

Economic Analysis: CPI data provides insights into the overall health of the economy. It helps in identifying periods of deflation or inflationary pressure, which can have a significant impact on business profits, consumer spending, and investment decisions. Moreover, CPI figures can be compared to other economic indicators to gain a more comprehensive understanding of economic trends.

Market Research: Businesses use CPI data to evaluate the impact of price changes on consumer demand and adjust their pricing strategies accordingly. By analyzing CPI trends, companies can make informed decisions about product pricing, expansion plans, and market potential.

Asset Valuation: CPI is also utilized in adjusting the value of assets and investments. Real estate investors, for instance, rely on CPI to assess changes in property values and determine rental rates.

Historic CPI

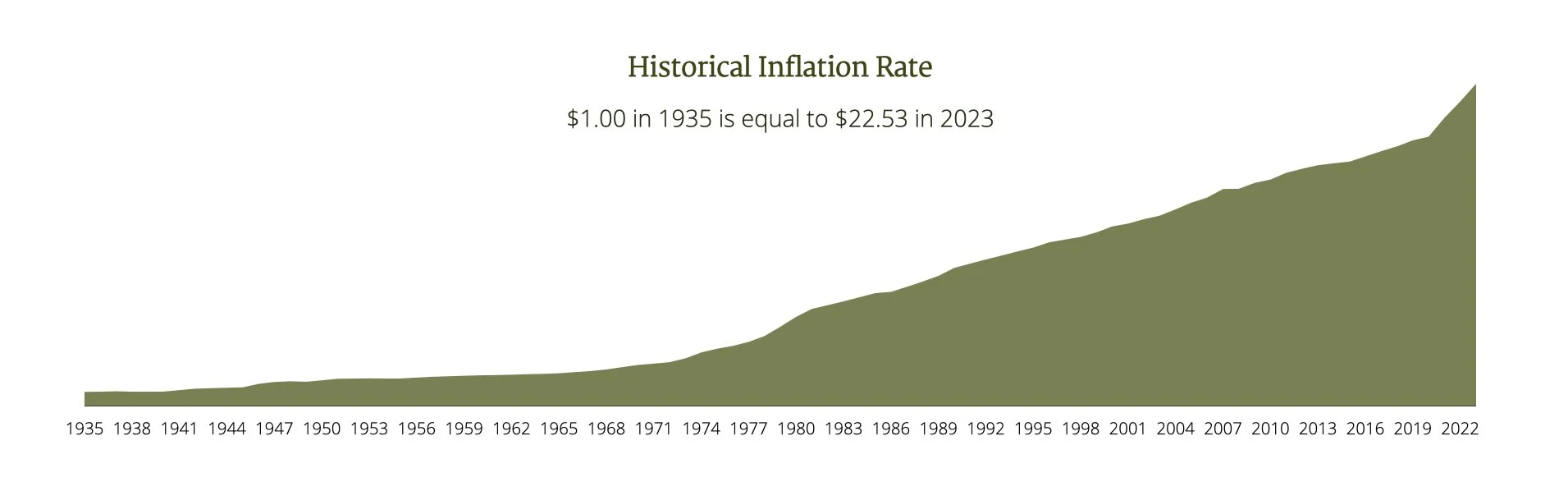

Over the years, the CPI has experienced fluctuations influenced by various factors, including economic cycles, policy decisions, and external events. It serves as a reminder that maintaining price stability is a constant challenge and requires a delicate balancing act by policymakers to support sustainable economic growth while keeping inflation in check.

Low Inflation Era: In recent decades, many developed economies have experienced relatively low inflation compared to historical levels. This period of low inflation can be attributed to factors such as globalization, technological advancements, and improved central bank policies.

Economic Cycles: Inflation rates tend to fluctuate in response to economic cycles. During periods of economic expansion, inflation may rise due to increased consumer spending and higher demand for goods and services. Conversely, during economic downturns, inflation may decrease or even turn into deflation as demand weakens.

External Shocks: External events, such as financial crises or global pandemics, can have a significant impact on inflation rates. These shocks can disrupt supply chains, alter consumer behavior, and influence the overall price level.

It's important to note that inflation rates can vary significantly between countries and regions. Factors such as government policies, exchange rates, and structural characteristics of the economy can contribute to variations in inflation rates across different time periods and countries.

While CPI may sound like economist insider baseball, it plays a crucial role in our understanding of inflation, consumer purchasing power, and overall economic health. It impacts your daily cash flows and the long term success of your financial plan. This is why inflation is baked into the underlying assumptions of our financial models and is often a topic of discussion at our annual reviews. If you have more questions about CPI and it’s impact on your financial health, contact your Skyline advisor.

Economic News Release. Bureau of Labor Statistics. June 16, 2023

News Release. Bureau of Labor Statistics. February 14, 2023

Icons by Eucalypt on The Noun Project. 06/2023

Other Sources:

Inflation: Prices on the Rise. International Monetary Fund. 06/2023.

CPI, PPI — what do the indexes really tell us about inflation? NPR Marketplace. May 11, 2023.

What’s included in the Consumer Price Index and what isn’t? NPR Marketplace. November 22, 2021

United States Core Inflation Rates (1957-2023). US Core Inflation Calculator. 06/2023