Utilizing 529 Funds

Field Note: July 2022

You’ve been diligently saving into a 529 plan for your child’s college education future. Now, they’ve made it to high school graduation and have their acceptance letter for the fall. What do you do with the 529 now?

529 funds can be used to cover costs of attendance at in-state, out-of-state, public, and private colleges, universities or other eligible post-secondary educational institutions including trade schools. However, if you don’t follow the withdrawal rules, you may be subject to taxes and a 10% penalty.

It’s up to you to calculate the amount of the tax-free distribution and how you want to receive the funds. Here are five steps to help you navigate the 529 plan withdrawal process and avoid paying taxes and penalties on your savings.

1. Calculate your qualified education expense

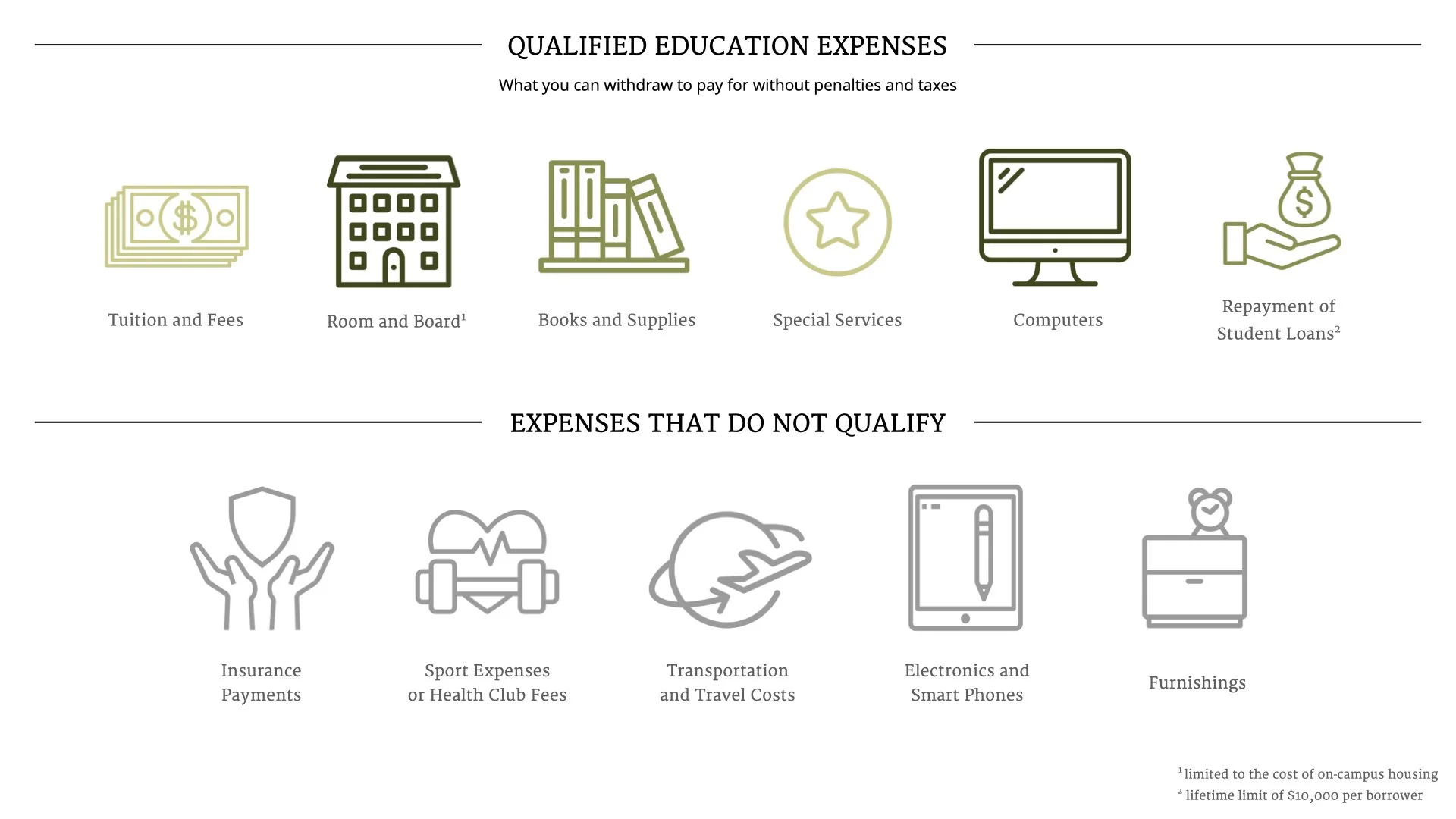

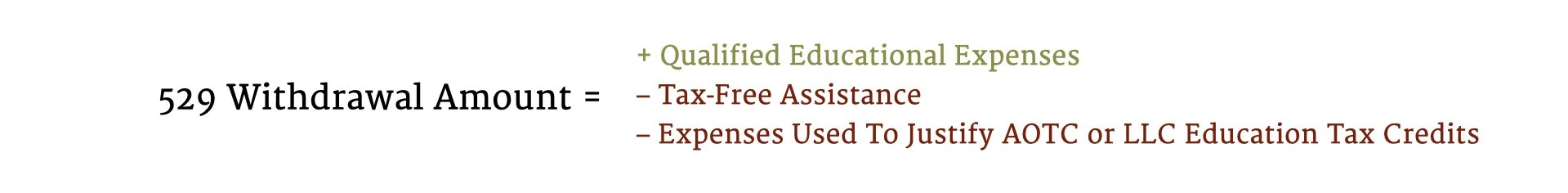

529 plan account owners can withdraw any amount from their 529 plan, but only qualified distributions will be tax-free. The earnings portion of any non-qualified distributions must be reported on a federal income tax return and is subject to income tax and a 10% penalty. To calculate qualified education expenses:

Add up:

College expenses including tuition, fees, books, supplies and equipment, computers and room and board. Note that qualified room and board expenses are limited to ‘cost of attendance’ the institution reports for federal aid purposes or room and board allowance if off campus.

Then, subtract the following:

Tax-free education assistance including tax-free scholarships, Pell grants, tuition discounts, educational assistance through a qualifying employer program, or Veteran’s educational assistance

Any expenses used to justify American Opportunity Tax Credit (AOTC) or Lifetime Learning Tax Credit (LLC).

AOTC is equal to 100% of the first $2,000 spent on qualified education expenses plus 25% of the next $2,000 for a maximum $2,500 tax credit per student. There is an income phase out that starts at $80,000 for filing single and $160,000 for married filing jointly.

LLC amount is 20 percent of the first $10,000 of qualified education expenses or a maximum of $2,000 per return. Its income phase out begins at $59,000 for filing single and $118,000 for married filing jointly.

2. Time the withdrawals correctly

529 withdrawals must be made in the same tax year of the payment of qualifying expenses, not the same academic year. Often, the most practical approach is to make withdrawals semester by semester as the academic year spans multiple calendar years.

3. Complete a withdrawal request

Account owners can withdraw 529 plan funds by completing a withdrawal request form online. Some plans also allow 529 plan account owners to download a withdrawal request form to be mailed in or make a withdrawal request by telephone.

If possible, avoid making the distribution payable to the account owner. It is best to send distributions directly to the beneficiary’s college or K-12 school. If that’s not possible, make them payable to the beneficiary. Non-qualified distributions payable to the owner may result in a higher tax liability.

For Oregon College Savings Plan: Make a request through your online account or fill out this form. The paper form allows OSCP to write a check directly to an intuition, but requires a notary.

4. Keep pristine records

Keep receipts of your qualified higher education expenses and your annual withdrawals (most 529 plans should issue an annual 1099-Q). If your returns are scrutinized someday, you’ll want to be prepared.

5. What to do with leftover funds in a 529 plan?

If there are leftover funds in a 529 plan account after the beneficiary graduates from college, or decides not to go to college, the 529 account owner may:

Use the money to make student loan payments (up to a lifetime limit of $10,000 per borrower)

Change the beneficiary to a qualifying family member who will use the funds for college

Keep the funds in the account to use for graduate school or continuing education

In the worst case scenario the account owner liquidates the account and pays income tax and a 10% penalty on the earnings.

If you have questions about efficient education funding practices, don’t hesitate to reach out to your Skyline advisor.