Socially Conscious Investing

Field Note: September 2021

If you’re looking for investment trends beyond GameStop, look no further than socially conscious investing.You may have also heard it referred to as sustainable investing, values-based investing, ESG, or SRI. Funds flowing into socially conscious investing have more than quadrupled in the last three years and total assets under management are up nearly 150% in the same time frame1. In this month’s Field Note, we’ll offer guidance in navigating the socially conscious investing landscape including what to consider if you want to align your investments with your personal values.

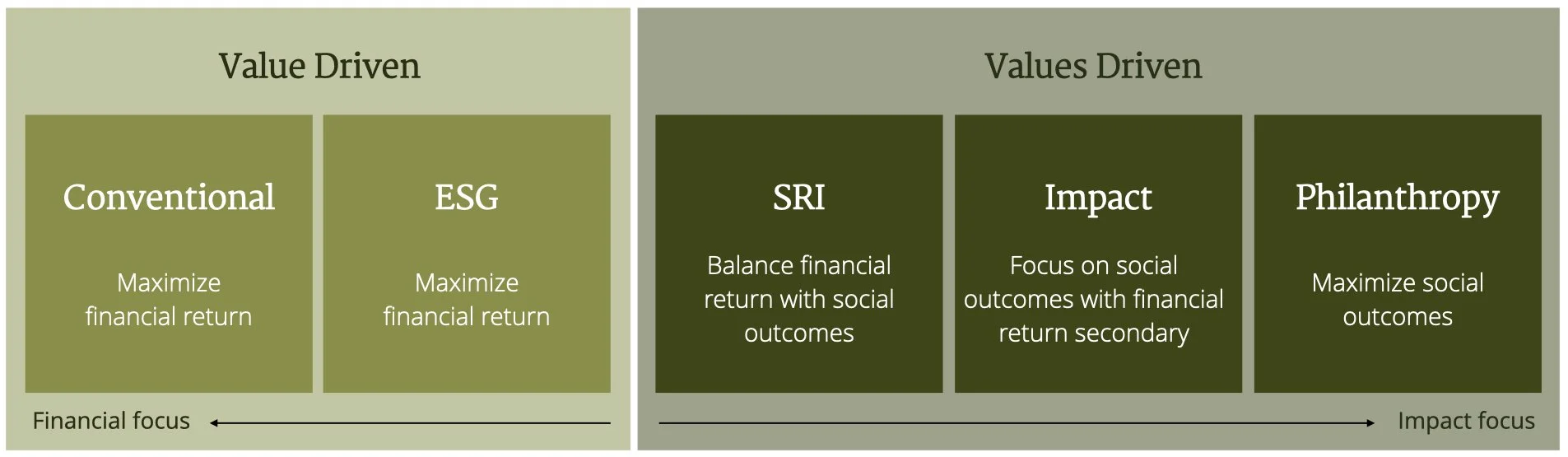

There is a spectrum of sustainable investing from conventional investing (no consideration for social outcomes or personal values) all the way to philanthropy (no consideration for financial return). There are three primary strategies that lie in between:

ESG — Environmental, Social, and Governance. In investing, a way of evaluating the environmental, social, and governance practices that have potential bearing on a company’s financial performance. ESG ratings are integrated with other traditional financial analysis metrics to determine quality of the investment in a company. This practice introduces a social conscience into the investment sphere, but the main objective of ESG remains financial performance.

SRI — Socially responsible investing goes further than ESG by actively eliminating or selecting investments according to specific ethical guidelines through the use of positive or negative screens. The underlying motives are often religious faith, personal values, or political beliefs. While making a profit is still important, it is supervened by a set of principles.

Impact — In impact or thematic investing, positive outcomes are paramount —the investments need to have a positive social impact in some way. The objective of impact investing is to help a business or organization accomplish specific goals that are beneficial to society or the environment, regardless of whether success is guaranteed.

As financial advisors held to a fiduciary standard (a client’s best interest must come first), our primary focus and the reason clients engage a financial advisor in the first place, is to maximize financial returns. This places us squarely on the left side of the graphic above. For this reason, the remainder of this post will focus on ESG.

It should be noted that we always encourage philanthropic intentions from clients when the desire is there. And, we would be willing to give our best thoughts and analysis to any type of impact investment. When it comes to SRI, we’ve found that most funds of this type tend to have more controversial ethical guidelines and exclusions, making them less than ideal candidates for our clients.

ESG Funds in Your Skyline Portfolio

Dimensional Fund Advisors (DFA), a fund company we commonly use, is known for its academic, data-driven approach to investing. They offer high quality and low cost passive investment funds. When we sought socially conscious investment options for our portfolios, we reviewed many options and returned again to DFA for their quality ESG funds. The DFA ESG funds focus on the environmental aspect of ESG through their Sustainability Core Equity Funds. The funds are built by applying sustainability criteria to a broadly diversified index. All companies receive a sustainability score based on five variables with greenhouse gas emissions emphasized most in the calculation (less greenhouse gas emissions and reserves results in a higher score).

DFA evaluates companies within each sector. Companies who have a higher sustainability score relative to their sector peers receive a greater weight in the portfolio, while those with lower scores receive a lesser weight or are excluded. This overweighting is a way to reward companies who are operating with more environmental responsibility within their sector and increase diversification by not excluding entire “bad actor” industries. For example, rather than excluding all oil and gas companies, a gas company with significant resources dedicated to alternative energy research would receive a higher sustainability score and represent a larger portion of the oil and gas industry in the portfolio than a peer company who hasn’t made any significant effort toward sustainability.

Skyline uses the DFA Sustainability Core Equity funds and integrates them into our standard investment portfolios where it is appropriate. This means not all funds in our ESG investment portfolios are ESG-focused. Integration is based on the availability of quality ESG equivalents as well as the risk and return profile of each portfolio.

If you choose to adopt an ESG approach, SFNW will determine the appropriate ESG allocation for your portfolio using your Investment Policy Statement as a guide. Additionally, the tax implications of switching funds will be considered and advised upon.

Considerations for ESG Investing

ESG lessens the small value tilt

Our portfolios have a tilt toward small cap and value stocks. This is based on Nobel prize winning research by Fama and French showing these stocks tend to outperform over the long term. Companies with better ESG ratings are likely to fall into the large cap sector, as it takes significant capital to invest in ESG practices and report on them. Integrating ESG into your portfolio lessens the tilt toward small cap and value stocks. This is increasingly true in our more aggressive portfolios with the most small value tilt.

Statistically insignificant data on risk and returns

Relative to the stock market itself, ESG investing is comparatively new. Many funds are less than 10 years old with new funds being offered all the time. Given this short time horizon, there isn’t enough data to indicate whether the use of ESG ratings in investment portfolios statistically affect return or risk.

ESG screens increase investment expenses

The screens adopted to address sustainability issues are a cost to a portfolio. The weighted-average expense ratio of ESG funds as reported by Morningstar (an independent investment research firm) is 0.63% with 22% of those funds having an expense ratio of 1.0% or higher. For context, our portfolios at Skyline have an average expense ratio of 0.25% .

ESG screens decrease diversification

The exclusion or diminished position of stocks may reduce diversification of the overall portfolio and could result in some high-performing stocks being excluded.2

ESG data is self-reported and there is a lack of standards among rating firms.

There are 7 main providers of ESG ratings: CDP, Trucost, MSCI, Sustainalytics, Thomson Reuters, Bloomberg, and ISS. Each agency relies on its own analysts and algorithms to review the self-reported disclosures of ESG metrics by companies. This results in large discrepancies and a question of quality over self-disclosure.

Research suggests consumer habits are more effective than investing in changing corporate behavior

Buying ESG stock on the secondary market doesn’t have a direct day-to-day impact on the company itself. The more effective way to influence a company’s bottom line is with your purchasing power and where you choose to spend your money.

ESG increases feel-good feelings

Firms that engage in ESG create a sense of purpose and motivation to employees. Investors who own ESG stock feel good about their contributions to the investment landscape.

High ESG affords low cost of capital and more ESG investing

As ESG increases in popularity, it is being reflected in an increase of stock prices for higher scoring ESG companies. As a result, companies with higher ESG ratings can access a lower cost of capital than those with lower ESG ratings (i.e. sell fewer shares into the market to get a given amount of new capital). This easier access to capital lets companies do more — expand into new areas, build new products, and continue their focus on sustainability for a competitive advantage.

In Conclusion

The decision to include an ESG strategy into your investment portfolio depends on a number of factors, including your own financial goals, risk tolerance, personal beliefs, resources, and preferences.

Contact your Skyline Financial NW advisor to discuss how to best align your personal values with your investment portfolio.

Alyssa Stankiewicz, (04/30/2021), Sustainable Fund Flows Reach New Heights in 2021’s First Quarter. Morningstar.

The materiality of this can be measured by research completed by Eric Crittenden and Cole Wilcox who studied the Russell 3000 during 1983-2006. Their key findings indicate that losing a few stocks could have significant consequences for a portfolio:

39% of stocks had a negative lifetime total return (2 out of every 5 stocks are money losing investments)

18.5% of stocks lost at least 75% of their value (Nearly 1 out of every 5 stocks is a really bad investment)

64% of stocks underperformed the Russell 3000 during their lifetime (Most stocks can’t keep up with a diversified index)

A small minority of stocks significantly outperformed their peers (Capitalism yields a minority of big winners that all have something in common)